The COVID-19 Crisis Management Fund and further state support measures

The Austrian Parliament has created the legal basis for financial support measures to tackle the COVID-19 crisis. In addition, existing aid programmes have been adapted.

In the following you will find a summary of the most important Q&As.

1.

The COVID-19 Crisis Management Fund

What is the volume of the fund?

The Federal Government has already announced a massive increase in the Fund's resources (to up to EUR 38 billion).

What can the COVID-19 Fund be used for?

The legislation enumerates the following examples:

- measures to stabilise health care.

- measures to revive the labour market (especially short-time work within the meaning of Section 13 para 1 of the Labour Market Policy Financing Act (AMPFG)).

- measures to maintain public order and security.

- measures in connection with the requirements for educational institutions.

- measures to cushion the loss of income as a result of the crisis.

- measures in connection with the Federal Epidemic Act 1950, Federal Law Gazette No. 186/1950.

- measures to revive the economy.

Who can benefit from the financial measures?

Companies that have their headquarters or a permanent establishment in Austria and carry out their main operational activities in Austria.

The Federal Minister of Finance will issue guidelines (by ordinance) for the granting of financial measures, in particular in regard to:

1.

the group of beneficiary enterprises.

2.

the form and purpose of the financial measures.

3.

the amount of the financial measures.

4.

duration of the financial measures.

5.

rights of the Federal Government (or the authorised representative) in regard to information and inspection.

These guidelines have not yet been adopted.

In a first step, the BMF issued – by ordinance on 17 March 2020 – guidelines for the granting of financial resources from the Fund (so-called “COVID-19-Fonds-VO”, Federal Law Gazette II No. 100/2020). The BMF will disburse the Fund's resources to individual federal ministries in accordance with a more closely regulated disbursement procedure and in accordance with evidence of compliance with (at least) four specified disbursement conditions. The disbursement will be effected in agreement with the Vice-Chancellor.

The federal ministries will then distribute the Fund’s resources to the companies.

How are the resources of the COVID-19 Fund administered?

The Federal Wind-Down Stock Company ("ABBAG") acts as an "extension" of the Minister of Finance in "providing services and [in] taking financial measures in favour of companies which are necessary to maintain the solvency and bridge liquidity difficulties of these companies in connection with the spread of the SARS-CoV-2 pathogen and the resulting economic effects" (Section 2 para 1 No 3 ABBAG Act).

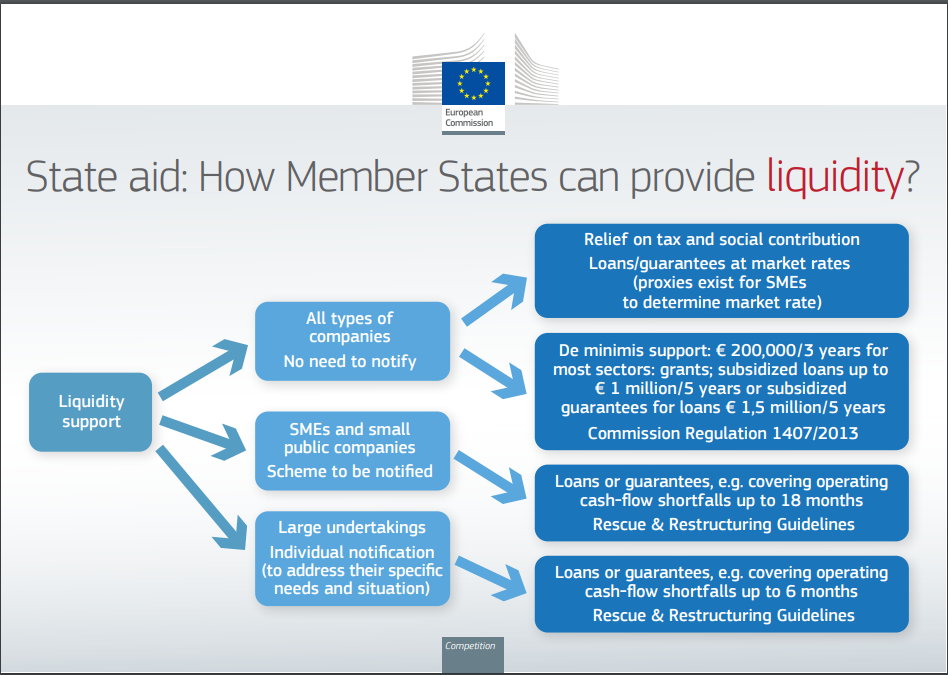

Is EU state aid law to be observed?

In the context of national measures, the applicable provisions of EU state aid law must be complied with. The European Commission is also calling for compliance with EU state aid law: the ample support measures by the Member States should be designed "in accordance with the existing EU state aid rules". To this end, the Commission has provided the following overview:

Against the background of the Corona crisis, Article 107 para 2 lit b TFEU enables Member States to compensate companies for the damage directly caused by exceptional occurrences without such aid being incompatible with the internal market. On this legal basis, the European Commission has already approved the Danish “Compensation scheme for cancellation of events related to COVID-19” on 12 March 2020 (see State Aid SA.56685 (2020/N)).

Moreover, the European Commission could authorise additional national support measures under Art 107 para 3 lit b TFEU (i.e. "to remedy a serious disturbance in the economy of a Member State"). Currently, this is only envisaged for Italy; however, the European Commission could take a similar approach for other Member States and is currently preparing a special legal framework under Art. 107 para 3 lit b TFEU, to be adopted in case of need.

2.

Support measures by Austrian bodies outside the COVID-19 Fund

As the COVID-19 crisis progresses, media coverage has shifted to the topics of short-time work and the COVID-19 Funds. This overlooks the fact that Austria has already put together the first support packages for particularly affected companies from 11 March 2020, i.e. very quickly. In the following we summarize the measures adopted in the early phase:

Austria Wirtschaftsservice Gesellschaft mbH (aws, Austrian promotional bank): The programme "Bridge-Finance-Guarantees due to the Corona Virus Crisis" with a volume of up to EUR 10 million provides support for liquidity bottlenecks caused by loss of sales as a result of the COVID-19 crisis and is intended to provide interim financing of measures (e.g. short-term adjustment of supply chains and customer relations). Funding will be provided for working capital financing (e.g. purchases of goods, personnel costs) to financially sound small-scale and industrial SMEs (companies in the tourism and leisure industry are excluded). The guarantee can be used to secure up to 80% of a bridging loan of up to EUR 2.5 million per SME. The term of the bridging loan is max. 5 years. The programme is being implemented on the basis of the aws Directive for SMEs, with a focus on the "Bridge-Finance-Guarantees due to the Corona Virus Crisis".

- Further information can be downloaded under https://www.aws.at/aws-garantie/ueberbrueckungsfinanzierungen/.

- Federal Ministry of Agriculture, Regions and Tourism and Österreichische Hotel- und Tourismusbank (ÖHT): SMEs in the tourism and leisure industry, which are expecting a 15% decline in sales compared to the same period of the previous year due to the coronavirus crisis, are to be given quick and unbureaucratic access to reduced-interest loans. Guarantees will be made available to tourism businesses so that they can take up bridging loans from their banks. The costs usually incurred for such guarantees (one-off processing fee of 1% and guarantee commission of 0.8%) are fully covered by the Federal Ministry of Agriculture, Regions and Tourism. The bridging loan can amount to a maximum of EUR 500,000 (secured with a federal guarantee ratio of 80%). The volume of liability made available by the Federal Government for this special campaign amounts to EUR 100 million. Since Wednesday 11 March 2020, 3 p.m., affected tourism businesses can submit applications at www.oeht.at.

3.

Support measures from the Austrian provinces

Several provinces have already announced additional funds for the companies in the region.

These aid programmes have been designed according to the EU state aid rules, in particular Art 107 TFEU, the General Block Exemption Regulation (TFEU), the de-minimis Regulation and the rules on state aid in the form of guarantees.

Please note: This newsletter merely provides general information and does not constitute legal advice of any kind from Binder Grösswang Rechtsanwälte GmbH. The newsletter cannot replace individual legal consultation. Binder Grösswang Rechtsanwälte GmbH assumes no liability whatsoever for the content and correctness of the newsletter.